2024 PropTech Trends

A Brief Overview of Where We Are and How We Got Here

Entering 2023, the tech community and world at large were hoping for a reprieve from the rollercoaster we’ve been on since 2020, but, alas, volatility continued. A new barrage of black swan events hit the markets: SVB’s collapse in March, a banking crisis shortly thereafter, an abhorrent terrorist attack on Israel followed by a subsequent war in the Fall, inflation running amok, uncertainty surrounding monetary and fiscal policy at home and abroad, and suppressed capital markets and transaction volumes resulted in another challenging year.

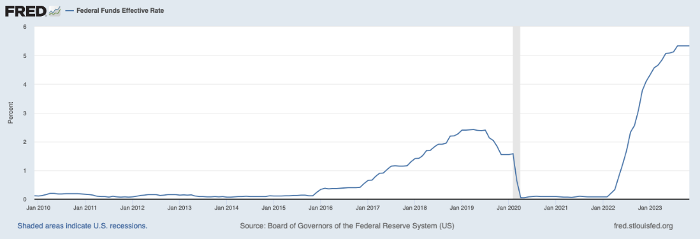

A result of the higher rate environment and uncertainty was that money flowed out of equities and into less risky, potentially higher yielding assets. The era of “free money” came to a halt.[1] Public equities meaningfully retrenched below their early 2022 highs, albeit closer to their historical medians, and private capital markets froze with few exceptions (AI).[2] Transaction volumes slowed across real estate asset classes as bid and ask spreads remained wide and prevented deals from getting done. Startups whose business models are tied to real estate transactions and adjacent services like appraisals, inspections, and titles were impaired. These dynamics unfortunately squeezed startups and ultimately created a tough year that included slower growth, smaller budgets, pay cuts, layoffs, and/or shutdowns.

By the end of the year, markets began to see glimmers of hope in the form of positive macroeconomic measures. The most aggressive fiscal policy in decades fortunately started to temper out-of-control inflation and restore some level of confidence in the markets, especially in real estate.[3] Unsurprisingly, Nine Four Ventures simultaneously started noticing a considerable uptick in company performance across the portfolio. Growth slowly (and in some cases, quickly) picked up again, sales cycles stopped stretching longer, and deals were getting done again even during what is often a slower holiday season.

Federal Funds Rate Data[4]

All that said, it wouldn’t be fair to give all the credit for a potential rebound to fiscal and monetary policy decision makers. Startup founders and teams worked hard and had to make difficult decisions throughout the year. Many companies used 2023 to put their heads down, re-focus on core products and strategy, and re-align on ‘North Star’ metrics (i.e. unit economics, reducing burn, etc.). Sometimes, slowing down to go fast is the right thing to do, but sacrificing growth for increased efficiency is easier said than done, especially in an industry that’s been conditioned with a growth-at-all-costs mindset. We’re observing that the startups that made tough decisions early and created a path to sustainability dramatically improved their odds of survival, and they will be in a stronger position to grow faster and more efficiently with less competition once the proverbial wildfires are out.

Recent dovish Fed commentary and general market sentiment around inflation and jobless claims have led many to believe a rate cut could happen in March, along with a corresponding ‘soft landing’. The NASDAQ has also recovered many of the gains it lost over the last twelve months.[5] Anecdotally, things feel better, or at least feel like there is light at the end of the tunnel for a better year. In the long term, we remain enthusiastically optimistic about technology’s potential and positive impact on the built world and the people, processes, and ecosystems that interact with it. We continue to be impressed by founders and investors who are thinking creatively and differently, and those who are recognizing a variety of ways to operate and capitalize on their PropTech businesses. In the near term, though, we’ll focus on ’24 and how we think it will unfold.

So, what’s in Store for ‘24?

Our assessment of how things develop in ’24 is that some trends will give way to gradual, then all-of-a-sudden change, with inflection points driven by the FOMC (unless a cataclysmic and/or unknown event happens to shift the playing field drastically, which we expect will always be the case). The Fed’s next meeting is Jan 30-31, followed by March 19-20. The March meeting is the meeting associated with a summary of economic projections so all eyes will be on that.

With that as context, we’ll discuss some trends that are likely already well covered, but that we believe will crest in ’24 to bring about waves of change relative to what we’ve seen in the past.

Back to the Grind: A great resetting for startup growth and valuation will give way to M&A and an older-school mindset for capital use and profitability.

Tension Between ESG Impacts and Financial Returns: As important as this is, many landlords are focused on the bottom line, and many ESG initiatives are tough to pencil in. Who will win if landlords are mandated to implement solutions that turn out to be a tax to them and their investors?

The Continued Evolution of InsurTech: Insurance is a tough market, as many early public InsurTechs can attest to. But not all hope is lost.

Streamlining Capital’s Access to Different Asset Classes: Technology continues to open institutional capital to historically tougher-to-access asset classes – we think this will be more prevalent in ’24.

Addressing the Trade Gap, Starting with FinTech: This problem isn’t new and isn’t close to being solved. Tech could help.

Playing Nice with Neighbors (…and How Nearshoring Might Help the US): Global conflict and uncertainty have US buyers of building materials on edge. Nearshoring may be a relief valve for risk and cost reduction as uncertainty carries through another year.

Back to the Grind

2023 was a year of adjustment. Startups that hired for growth reduced headcount – many very aggressively – as they quickly realized that the growth they were expecting wasn’t going to happen. Unit economics came back into vogue, and as the tide receded, it became apparent who was wearing clothes and who was not. Once dominant PropTech players such as WeWork, Veev, Convoy, and Zeus Living went from as high as unicorn status down to nothing.

Total Tech Layoffs and Tech Companies with Layoffs[6]

Real estate is seasonal across a year, and cyclical over several years. Buying, selling, building, and renovating activity is generally higher in the spring and summer, and slows down in the winter. So, transaction volume – and revenue, if your business model is transactionally dependent – typically resembles rolling hills, ideally with a trend line up and to the right. Transactions also tend to move with interest rates: when rates are low, transaction volumes are higher as debt is cheaper and buyers can purchase more for less cash. When rates are high and borrowing money is expensive, transaction volumes are lower as the opposite occurs. Sellers who are locked into low financing rates don't want to sell in this higher rate environment, especially since prices haven't yet adjusted downward enough, therefore resulting in low inventory whereby sellers are those who are forced due to downsizing, liquidity needs, a move to a new city, etc. This confluence of factors such as low inventory, high prices, and high mortgage rates create a standstill and an environment tough for both sides to get anything done.

Almost two decades ago, the Fed dropped interest rates to historic lows to combat the Global Financial Crisis (“GFC”). Rates remained there with some modest fluctuation until inflation ran amok in 2022. During that time, PropTechs benefitted from an unprecedented period of low rates and higher transaction volumes to drive growth. Many simultaneously, and regrettably, set up distorted cost structures based on what we now know were artificially high activity levels: startups that need X transactions to turn a profit at the corporate level may only get Y… and Y could be zero. Many underestimated just how sensitive real estate could be to interest rates, how fast activity can change, and how quickly that can impact growth, burn, and runway.

There’s a saying to “make hay while the sun shines” – many did, but they weren’t prepared to survive when the storms came. Startups in the PropTech space should heed this as a warning: it’s okay to hire fast and take advantage of the good times, but you also need to be ready for the downside and accommodate for the bad times just as quickly. For transactionally driven startups, we believe an approach with a healthier tension between growth and efficiency will lead to fewer failures, more successes, and create more durable, lasting businesses that deliver long-term value.

All of this leads to some changes that we expect to see in ’24:

Pre-seed:

Most pre-seeds we see are now more focused on efficient cash use and not subject to massive valuation overhangs. Competitive deals will always bid prices up, but we simply aren’t seeing things move as quickly or valuations get nearly as high as what we’ve seen in prior years (except for AI). ’23 pre-seed founders may have pulled the remaining rabbits out of the hat for massive raises at big valuations ahead of product development and revenue, with ’24 startups coming out of the gates with cleaner cap tables and the mindset of building a more sustainable company.

Seed:

Seed rounds are increasingly getting tougher to raise as the goalposts for investors shift to more mature companies. Over the years the parameters around each round letter evolve, with 2021 Series A’s getting priced like Series C’s with the traction of traditional Seed stage startups. Valuation and traction expectations are now collapsing more around a singular round letter, and we expect this to continue throughout the year. We expect Seed rounds will shift back to the ~$2-3M rounds, priced, 12-18 months runway, with a line of sight to $1M+ ARR (if software), for example.

Series A:

We expect that Series A fundraising will be more challenging for startups compared to prior years. Multiples are compressing and operational bars are higher as later-stage investors place more value on efficiency, profitability, and market size.

This is also the point where we expect a more meaningful M&A buy-box to open: companies at this stage may have real technology and teams, but not capable of the outcome they perhaps once thought they would. Strategics and larger startups that have cash could find gold in these companies and drive more consolidated industries.

It’s now back to the grind of building startups with efficiencies and profitability in mind. While things may look better at the macro level, the “Survive til ‘25” saying continues to ring.

Tension Between ESG Impacts and Financial Returns

Climate change is an existential threat to humanity, and attracting a commensurate amount of founder, investor, and regulator attention seems like a good start to solving the problem. New regulations like Boston’s Emissions Reduction and Disclosure Ordinance now require large existing buildings to reduce their greenhouse gas emissions starting in 2025.[7] These mandated programs are creating urgency for landlords and opportunity for startups: one year isn’t much time for owners and managers to comply, so they need to move quickly or be at risk of expensive fines, penalties, and/or reputational harm.

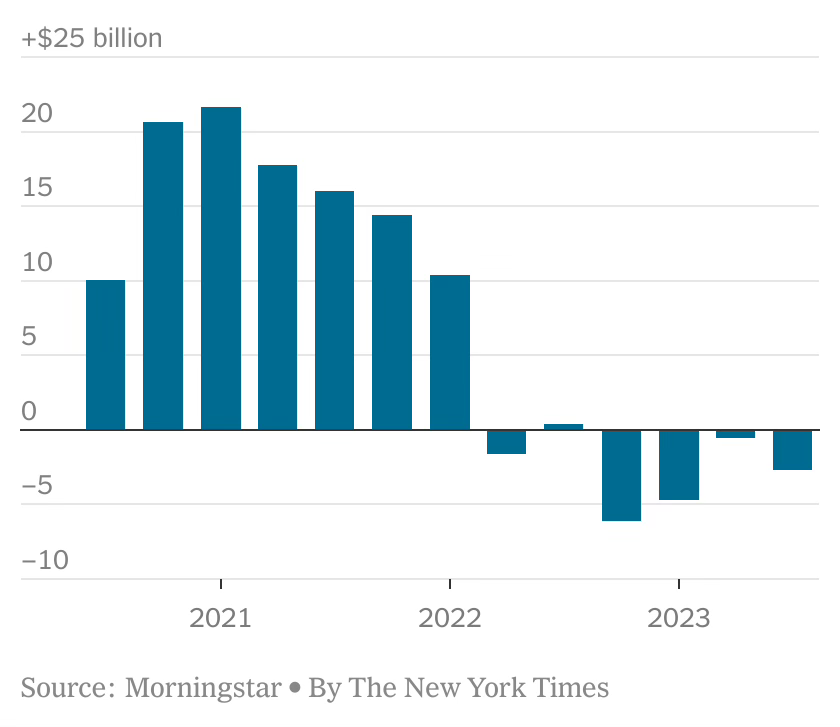

Cracks in the plan, however, are appearing. While new regulations are putting helpful systems in place to save the planet, create purchasing urgency, and attract climate tech startups, these laws combined with an increasingly challenging operating environment are putting owners and managers between a rock and a hard place. Stakeholders are strained by lower rents and higher vacancies and delinquencies, which impact their NOI, capex reserves, tech budgets, and overall team resources. Every dollar spent is being scrutinized by finance teams while managers fight for their survival. As a result, we’ve noticed that ESG customer behavior around purchasing software, installing hardware, training internal teams, etc., has dropped on the hierarchy of needs across the landscape. This doesn’t mean it isn’t important or we won’t see adoption in the future. However, it could mean more friction in sales processes, slower growth, shorter runways, and a lower return profile than originally anticipated. We’re already observing reduced investment flows into ESG funds, with other funds shedding sustainability mandates altogether.

Quarterly Investment Flows to ESG Funds[8]

Sustainability Fund Rise in Closures and Fall in Launches[9]

Those dynamics, combined with the fact that many ESG startups are capital intensive, don’t create as attractive of a backdrop as some may have hoped for. This problem could come to a head in ’24 if the impacts that climate tech and/or cleantech startups have been pitching aren’t felt on the bottom line. Subsidies could help, but we don’t expect those to be the answer. We don’t usually delve into politics, but ’24 could be a year of serious tension between landlords and governing bodies.

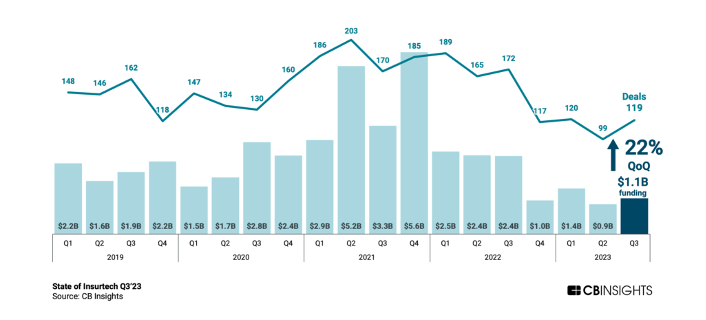

The Continued Evolution of InsurTech

Lemonade, Hippo, and Root Insurance were the poster children of venture-backed, digitally native InsurTechs during the hype cycle of 2020 and 2021. They pioneered and successfully navigated the transition from agency to MGA to carrier. This strategy allowed them to grow quickly as agencies and MGAs while offsetting balance sheet risk and subsequent profits to reinsurance partners early in their companies’ lives. Eventually, the carrier model (premiums – losses from claims – some SG&A expenses = profits) compelled these companies to evolve their agency/MGA business models to drive meaningful future cash flows at scale, but they learned that it is much more challenging to execute than it may appear.

Lemonade, Hippo, and Root were rewarded for growth and promised investors that high loss ratios would improve over time. Although they’ve made some headway there, it hasn’t been enough. It’s becoming clear from their 2023 performance that the growth-at-all-costs mindset of keeping underwriting goalposts wide and worrying about loss ratios in the future is tough to reverse. The underwriting decisions insurance companies make today drive future profitability, so if current underwriting is bad, profits will be low (or negative), and create a downward spiral that is difficult to recover from.

Just because it is tough doesn’t mean it shouldn’t – and couldn’t – still happen though. If a technology backbone can drive fundamental improvements across acquiring, underwriting, servicing, and retaining policyholders, it makes sense to graduate to a carrier, hold risk on balance sheets, keep profits, and be valued at a premium relative to others. Public InsurTechs are now evolving and focusing on profitability. The big question is whether they can be more profitable and/or grow larger than the non-tech-enabled business models of incumbents. ’23 was almost a full year of these companies trying to right their ships. ’24 could be the time when we get to a logical conclusion of what the boundaries are for startups and digitally native companies to impact the insurance industry. Can they adopt and deploy AI more rapidly and more efficiently than incumbents? Or will incumbents arm themselves with AI that holds off startup competition and shores their defenses against potential disruptors?

InsurTech’s Rebound Towards end of 2023[10]

Streamlining Capital’s Access to Different Asset Classes

We’ve been watching and investing in startups that allow capital, particularly institutional capital, to access traditionally overlooked and underinvested asset classes.

For the first time, startups such as Nine Four portfolio companies Vontive and Ease Capital are identifying segments that aren’t new (single-family rentals and small CRE debt, for example) but have largely been inaccessible to institutions. Startups are building streamlined originating, underwriting, and servicing technology that’s reducing cost barriers for institutions and delivering faster, cheaper, and fully digital experiences to borrowers.

To give a sense of the size and scope of the potential opportunities, there are 14.3M single-family rentals in the United States out of a total housing stock of 82M.[11] [12] About 1M are owned by institutions but that number is expected to increase to over 7M by 2030.[13] On the CRE side, 97% of multifamily properties in the United States are financed with loans under $30M.[14] Those numbers are meaningful and too large to overlook.

US Single-Family Rental Ownership by Investor Portfolio[15]

Large, non-institutionalized markets combined with developing market voids could support large startups and lead to attractive outcomes. When SVB collapsed it triggered a subsequent worldwide banking crisis, with smaller, local banks erring towards more conservative balance sheets and underwriting. This created a hole in the market and an opportunity for startups to deliver capital directly like Vontive and Ease Capital or provide the tech infrastructure, such as Finley,required for fast growing traditional private credit funds.[16]

The banking crisis’ blast radius reaches far beyond single-family homes and small CRE. It formed and uncovered gaps across other traditionally overlooked and underinvested asset classes, types, segments, and geographies. As a result, we’re bullish on the opportunities for asset management technology to streamline institutional capital into less competitive markets in ’24. Just how large of an impact startups can have in driving private capital into opportunities others are leaving behind remains to be seen, but we think we’re going to find out this year.

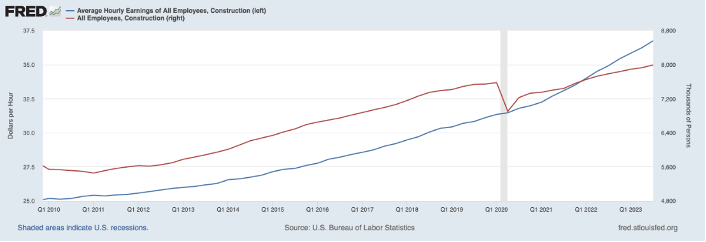

Addressing the Trade Gap, Starting with FinTech

Skilled trades are the backbone of many industries, shaping and sustaining the structures and systems that define our modern lives. From constructing and maintaining single-family homes and commercial buildings to overseeing airplane operations and manufacturing lines, tradespeople play a pivotal role in ensuring the functionality of physical goods. Despite their significance, we believe the trade schools responsible for creating the next generation of mechanics, plumbers, truck drivers, and more, have often been overlooked and underinvested, which has resulted in a further growing skilled labor deficit. According to Associated Builders and Contractors, “The construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor.”

Construction employment took a dive during COVID and hasn’t kept pace with demand[17]

While founders and investors have focused their attention on the four-year university market, creating successful players like Anthology, Blackbaud, Ellucian, and Navient, trade schools have been left in the dark. The financial infrastructure supporting higher education has grown extensively, enabling a broader range of financial alternatives and the servicing of trillions in tuition dollars.[18] This evolution has democratized access to higher education, making it more attainable for individuals who were previously excluded due to financial constraints.

Drawing a parallel to the transformation of the four-year university market, we see a similar opportunity for financial services and technology to revolutionize trade schools. By directing innovation and investment towards underserved players, we can help bridge the gap in skilled labor and empower a new generation of tradespeople. This shift could address the pressing need for skilled workers and ensure that opportunities for education and advancement are accessible to a broader spectrum of individuals, mirroring the positive changes seen in traditional higher education access.

Trade school tuition is tied directly to entrepreneurial, hardworking, driven students who aspire reliable, higher-paying jobs. Those characteristics could make them attractive future cash flows for institutional investors, but capital markets infrastructure is required to create a secondary market. Startups such as Mia Share, which streamlines tuition payments between students and schools with purpose-built software and controls relationships with relevant stakeholders, are well positioned to take advantage of the opportunity to bridge the gap. It’s also impossible to ignore the pressure on high-profile colleges, their leadership, and the economic implications for students. Is ’24 the year where more students take gap years to test the waters of a different career path? Or forego traditional 4-year universities to enter the trades and become business owners?

Playing Nice with Neighbors (…and How Nearshoring Might Help the US)

How big of a threat is China? Who will win the 2024 election? What will happen with the chip wars? Are global supply chains as fragile as they were at the onset of COVID?

Whatever the answers are, US buyers of foreign goods appear more focused on diversifying their supply chains and manufacturing partners to help mitigate risks. An obvious spot to look to is our closest neighbors: Mexico, LatAm, and Canada. While Canada has a more robust and stable economy than Mexico and our LatAm neighbors do, the latter is increasingly proving that they too can produce high quality goods that are closer to home and with less tax risk. Nine Four portfolio company Latii is focused on this opportunity and is building a marketplace for US buyers of LatAm building materials, where they’ve observed the highly fragmented nature of both sides of the building materials market. Latii is one of the few startups we see addressing this global problem/opportunity, despite there being a massive and continual need to reduce risk and costs for producers and consumers. BCG’s recently published report on the nearshoring opportunity gained some steam on the topic, and we’re seeing the nearshoring debate come into focus throughout early political debates.

Mexico Surpasses China as Main U.S. Manufacturing Trading Partner[19]

As noted earlier, this feels like a space that will see an inflection point one way or another post-election, or until a company like Latii gets to scale and proves the advantages pencil. ’24 might be a year where a bridge between the digital and physical ecosystems across borders materializes.

Thank You and Please Reach Out!

A big thank you to our founders and partners whom we’re fortunate to work with. Many of the insights learned and much of the work we’re most proud of involves them. We have lots of gratitude going into 2024 and hope we can make your jobs a little bit easier every day.

Please reach out If you’re an industry stakeholder considering adopting new technology or a founder starting a new company. We would love to hear your reactions to our post and speak with you!

Disclaimer:

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Nine Four Ventures. All views expressed herein are the opinions of Nine Four Ventures employees and are not the views of our affiliates or investors.

[1] Pitchbook: NVCA Venture Monitor, Q3 2023

[2] The Bessemer Cloud Index, Dec. 2023

[3] FRED: Federal Funds Effective Rate, Dec. 2023

[4] FRED: Federal Funds Effective Rate, Dec. 2023

[5] FactSet: Earnings Insight, Dec. 2023

[6]Layoffs.fyi Data, Dec. 2023

[7] City of Boston: Building Emissions Reduction and Disclosure, Dec. 2023

[8] Is ESG Falling Out of Favor?, Oct. 2023

[9] ESG Fund Closures in US Outpace Launches for First Time Since 2020, Oct. 2023

[10] State of Insurtech Q3’23 Report, Nov. 2023

[11] Joint Center for Housing Studies of Harvard University: 8 Facts About Investor Activity in the Single Family Rental Market, July 2023

[12] Statista: Us Single Family Homes – Statistics & Facts, Sept. 2023

[13] CNBC: Wall Street has purchased hundreds of thousands of single-family homes since the Great Recession. Here’s what that means for rental prices, Feb. 2023

[14] Reonomy CRE Data, Nov. 2023

[15] Single-Family Rental Market Fundamentals, Dec. 2023

[16] Preqin: Global Report 2023: Private Debt, Dec. 2022

[17] FRED: Average Hourly Earnings of All Employees, Construction, Dec. 2023

[18] FRED: Student Loans Owned and Securitized, Nov. 2023

[19] Mexico seeks to solidify rank as top U.S. trade partner, push further past China, July 2023